"Turn Mandatory AML/CTF Compliance into a Profitable Operating Model"

Property360 removes the uncertainty and risk around AML/CTF compliance while simultaneously restructuring your agency into a more efficient, valuable, and future-ready business.

Using its proprietary system, Property360 embeds a qualified, licensed Finance Manager directly into your agency—an individual already trained in AML/CTF obligations and accredited to operate Property360’s proprietary platforms. This is not a referral arrangement, a kickback scheme, or a bolt-on partner model.

Unlike traditional finance referrals that rely on inconsistent follow-up and provide no compliance integration, Property360 integrates a finance professional into your day-to-day workflow. Finance activity, AML/CTF compliance, and client data are managed through a single, structured process. The result is higher conversion rates, fewer failed transactions, and materially reduced compliance risk for the principal.

At the same time, the model creates a new, defensible income stream. The Finance Manager is contracted to your office, remunerated via lender commissions, with an agreed percentage allocated to your agency. There are no additional staffing costs, yet you gain the full benefit of an experienced team member who manages compliance and generates incremental, ongoing cashflow—adding value to your business rather than creating another compliance expense.

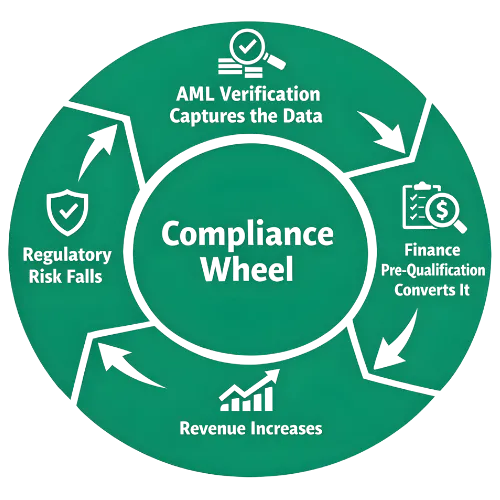

AML verification captures the data → finance pre-qualification converts it → revenue increases → regulatory risk falls.

Your New Agency Model Structure

“AML-secure from day one,

cashflow positive from month one.”

- Flexible Options -

Solo Agent Model

For solo agents, Property360 delivers enterprise-grade compliance and finance capability without the cost, complexity, or staffing burden. A licensed finance professional is embedded directly into your workflow, handling AML/CTF obligations, client verification, and finance pre-qualification alongside every transaction. This reduces your personal compliance risk, improves settlement certainty, and creates an additional income stream from transactions already being written. It’s a no-brainer for agents who want to stay independent while operating at a professional standard in a regulatory respect. Entry is selective — we partner only with agents committed to process, integrity, and long-term sustainability, ensuring the model works seamlessly from day one for you. For those who do not have a rent roll, Property360 will provide you with an alternate saleable asset. This is the key distinction: Property360 does not just create a finance trail book for your business— it converts a solo operator into a sellable business with enterprise value, something most agents do not have after five years.

One Office with Agents

For small to mid-sized offices, Property360 becomes a shared operating layer that standardises compliance, finance, and transaction support across all selling agents in your team. AML/CTF data capture, onboarding, and finance qualification are centralised and managed by a licensed finance professional, reducing your risk created by inconsistent agent practices. The result is higher conversion rates from your data, fewer failed transactions, and inevitable compliance oversight — without adding additional administration staff! This model creates a scalable, cashflow-positive advantage to your bottom line, incentivising and retaining your team, as opposed to competing agencies still relying on outdated referral arrangements. Unlike cloud based AML systems, Property360 lowers your AML risk further due to the embedded human oversight and is not an expense, property360 is income producing while creating a saleable asset. At Property360, we are deliberately selective, working only with leadership teams willing to drive adoption from the top down to protect their business and maximise outcomes.

Franchise or Multi-Office Group Model

For franchise networks and multi-office groups, Property360 provides a defensible, group-wide compliance and finance framework that scales without fragmenting accountability. The model embeds licensed finance capability across offices while maintaining consistent AML/CTF controls, audit trails, and reporting at licence level. This significantly reduces systemic risk, strengthens regulator defensibility, and unlocks group-wide revenue uplift through embedded finance. Unlike legacy referral models, Property360 aligns compliance, commercial outcomes, and governance in one structure. Participation is by design selective — ensuring franchise leadership, principals, and agents are aligned, disciplined, and committed to executing the model consistently across the network.

How does this differ from other AML/CTF compliance offerings?

Property 360 imbeds a qualified and compliant finance officer with AML/CTF skills, training and experience to undertake the necessary regulatory transaction tasks and reporting IN ADDITION to mining the data of the agency as an imbedded representative of that agency, discovering untapped leads, and converting ongoing financing opportunities = additional income stream and increase profitability of the agency.

FAQ's

What is the cost to embed a Finance / Compliance Manager?

There is a one-off setup fee of $1,000 (+GST) to source, appoint, and embed a qualified Finance / Compliance Manager into your office. Ongoing support and compliance services are provided for $495 (+GST) per month, (Office with agents) or $395 (+GST) per month for a sole agent, which covers the completion and management of required AUSTRAC documentation, monitoring, and reporting obligations.

Is the Finance/Compliance Manager a Mortgage Broker?

Yes — however, there are important distinctions.

While the Finance/Compliance Manager is a fully qualified and licensed Mortgage Broker, not all brokers are suitably trained or permitted to act as a compliance officer. Legislation requires that a compliance officer be embedded within the office and actively involved in day-to-day operations — not operating under a loose referral or external arrangement, which is common in traditional models. The Finance/ Compliance manager is autonomous and can source their own finance deals and run their own finance business independently of the real estate office.

Property360 Finance/Compliance Managers are specifically trained to operate within an office environment, working as an integrated member of the team. They are fully insured with appropriately adapted Professional Indemnity (PI) cover, trained in current AML/CTF legislation, and accredited to operate under the Property360 model.

In addition, Property360 uses a proprietary system that “risk-rates” every transaction — identifying low, medium, and high-risk clients — supported by advanced AML monitoring and reporting mechanisms. This ensures compliance is proactive, auditable, and consistent, while also enabling the Finance/Compliance Manager to contribute directly to business growth as a trusted, in-house professional.

How is this different from a standard finance referral arrangement?

This is not a referral model. The Finance/Compliance Manager is embedded within your office, operates under your brand, and is actively involved in transactions, compliance oversight, and client management. This structure aligns with AML/CTF legislation, improves conversion rates, and eliminates the compliance gaps commonly created by external or ad-hoc referral relationships.

Who is responsible for compliance risk and AML obligations?

Compliance responsibility remains with the business principal; however, Property360 materially reduces risk by embedding a trained Finance/Compliance Manager who manages AML/CTF processes, transaction monitoring, record keeping, and reporting. All transactions are assessed through Property360’s proprietary risk-rating system, ensuring consistent identification and escalation of low, medium, and high-risk clients.

Are the Finance/Compliance Managers insured, and does this expose the agency to additional risk?

No additional risk is created. All Property360 Finance/Compliance Managers hold appropriately structured and adapted Professional Indemnity (PI) insurance aligned to their role within an embedded office model. This insurance sits alongside lender accreditation requirements and Property360’s compliance framework, providing layered protection for the agency.

Note: This model is proprietary to Property360 and can only operate under a specific Australian Credit Licence (ACL) supported by an AML-compliant platform fully aligned with AUSTRAC legislation and reporting obligations. Real estate AML requirements are industry-specific and regulated; only appropriately licensed and qualified finance professionals may act as the Responsible Officer, with an appropriate reporting platform/system. A standard mortgage broker or finance operator may not meet these requirements, making your agency uncompliant and at risk.